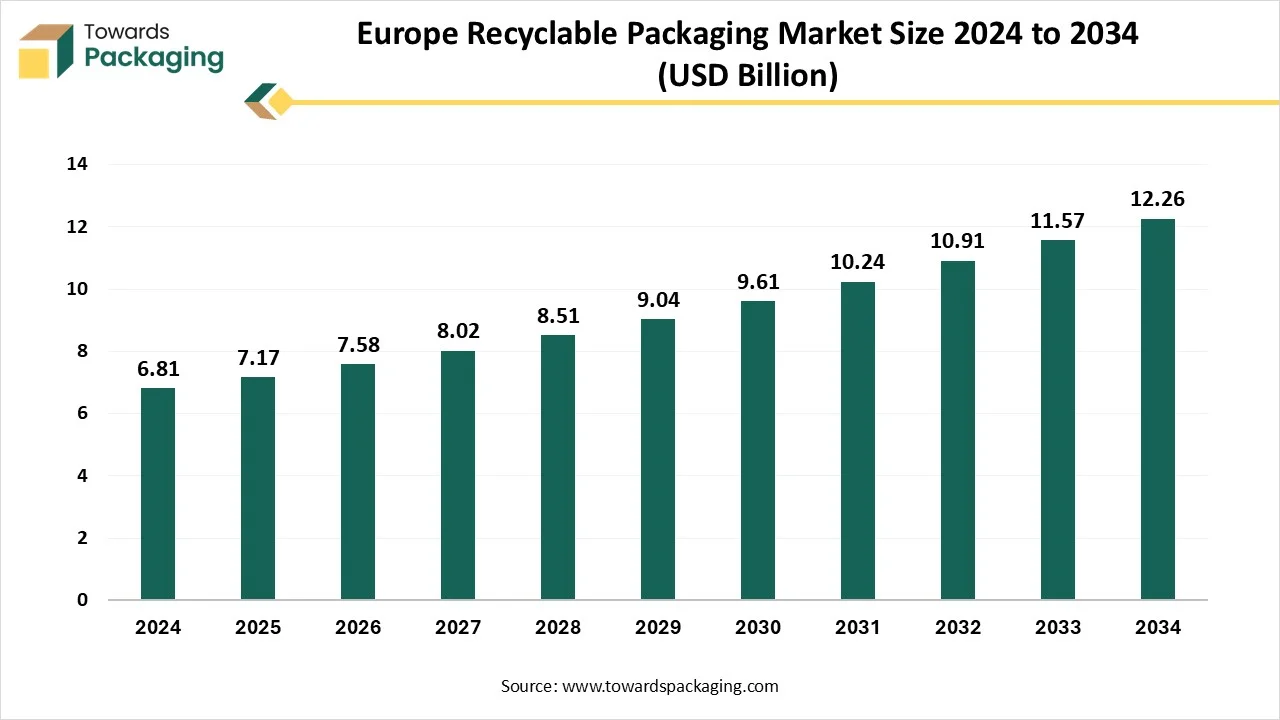

Europe Recyclable Packaging Market Starts from USD 7.17B in 2025 to USD 12.26B by 2034

According to a recent analysis by Towards Packaging, the global Europe recyclable packaging market is projected to expand from USD 6.81 Billion in 2024 to USD 12.26 Billion by 2034, recording a CAGR of 6.0% between 2025 and 2034.

Ottawa, July 11, 2025 (GLOBE NEWSWIRE) -- The global Europe recyclable packaging market size generated revenue of USD 7.17 Billion in 2025, and this figure is projected to grow to USD 12.26 Billion in 2034, according to research conducted by Towards Packaging, a sister firm of Precedence Research.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5628

The European recyclable packaging market is rapidly evolving due to strict EU regulations, rising consumer demand for eco-friendly solutions, and growing pressure on businesses to adopt sustainable practices. Key drivers include the Circular Economy Action Plan and bans on single-use plastics, pushing manufacturers toward paper, glass, metal, and mono-material plastics.

Innovations in bio-based and recycled-content materials are gaining momentum, supported by AI-driven design and recycling systems. However, challenges such as high costs, limited recycling infrastructure, and packaging contamination persist. Despite this, the market shows strong potential through unified labeling, scalable reuse models, and increasing adoption of smart, circular packaging solutions.

What is Recyclable Packaging?

Recyclable packaging refers to packaging materials that can be collected, processed, and reused to manufacture new products after their initial use, reducing waste and conserving natural resources. These materials include paper, cardboard, glass, certain plastics, and metals that meet recyclability standards. For packaging to be truly recyclable, it must be free from contamination, properly sorted, and compatible with existing recycling infrastructure. Recyclable packaging plays a vital role in promoting sustainability, lowering carbon emissions, and supporting circular economy goals. Consumers and companies increasingly prefer recyclable options due to environmental awareness and regulatory mandates encouraging responsible material usage and waste reduction.

Explore Strategic Figures & Forecasts – Access the Databook Now: https://www.towardspackaging.com/download-databook/5628

What Are the New Key Trends Shaping the Recyclable Packaging Market?

-

Mono-material packaging solutions

The mono-material packaging solutions are easier to recycle and preferred by MRFs (material recovery facilities). Growing use of flexible pouches, trays, and films.

-

Advanced recycled-content materials

Surge in post-consumer recycled (PCR) plastics and paper. Brands using >50% recycled content to meet ESG goals.

-

Plant-based and biodegradable alternatives

The use of seaweed, mushroom, bagasse, and corn-starch materials is done for manufacturing biodegradable packaging. Rise in compostable and edible packaging formats.

-

AI and digital innovation

AI-assisted packaging design to reduce waste. Smart sensors, QR codes, and IoT are used for traceability and recycling guidance.

-

Reusable and returnable packaging systems

Circular models are gaining ground in retail, food, and e-commerce. Supported by EU regulations and brand pilot programs.

-

Minimalist and clean-label packaging design

Reduction of inks, adhesives, and laminates to improve recyclability. Clear recyclability labeling to reduce consumer confusion.

-

Government regulations and bans

EU Packaging and Packaging Waste Regulation (PPWR) mandates recyclability by 2030. Extended Producer Responsibility (EPR) policies are driving design changes.

-

Infrastructure development in recycling

Investment in tray-to-tray and film-to-film recycling plants. Growth in regional collection and sorting capabilities.

-

Consumer demand for transparency and sustainability

Buyers increasingly prefer packaging labeled “100% recyclable” or “made from recycled content.” Brand loyalty is influenced by packaging sustainability.

-

Corporate sustainability goals (Net Zero, ESG)

Brands setting 2025-2030 targets for 100% recyclable packaging. Shift toward circular economy partnerships across the supply chain.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What Are the Key Growth Opportunities in the European Recyclable Packaging Market?

- Closed‑loop recycling facilities: New investments, such as Veolia’s UK PET tray‑to‑food-grade plant scheduled for 2026, can significantly increase local recycling capacity. The largest plastic recycling facility in Britain has been constructed by French environmental services provider Veolia (VIE.PA), which has invested 70 million pounds (USD 95 million).

- E‑commerce packaging demand: Surging online sales fuel the need for lightweight, recyclable cardboard, mailers, and mono‑material plastics.

- PPWR‑driven material innovation: EU mandates on recyclability, recycled content, compostable, and minimalist design encourage R&D in novel bioplastics, paper liners, and barrier coatings.

- Reusable packaging systems: Regulations requiring reusable targets (40%+ reuse by 2030) support roll-out of packaging-as-a-service models and refill infrastructure.

- Smart labeling & digital traceability: Harmonized eco-labels, QR/sensor-enabled packaging, and deposit-return systems offer opportunities in data-based consumer engagement and logistics.

- Collaborative innovation partnerships: Joint efforts across brands, recyclers, and tech providers like Citeo’s reusable glass project or Consumer Goods Forum initiatives can drive large‑scale impact.

- Policy incentives and eco-fees: Eco-modulated EPR fees and plastic taxes create advantages for brands adopting sustainable packaging, reducing costs and boosting brand image.

- Infrastructure expansion & automation: Scaling recycling plants, MRF upgrades, and AI/robot-powered sorting systems improve recyclate quality and boost market readiness.

Limitations & Challenges in Europe recyclable packaging market:

One of the main factors straining the growth of the Europe recyclable packaging market is the lack of harmonized recycling infrastructure across EU member states. While regulations are strict, many countries still lack advanced sorting, collection, and processing facilities. This inconsistency leads to low recycling rates in some regions and limits the efficiency of recyclable packaging systems. Other key challenges include: High cost of recyclable and eco-friendly materials compared to traditional options.

Complex packaging designs (like multi-layer films) are difficult to recycle. Contamination of recyclable waste due to improper disposal or labeling. Slow adoption of reusable systems due to logistical and behavioural barriers. Fluctuating demand and supply of recycled raw materials

More Insights of Towards Packaging:

- Circular Economy in Packaging Market - The circular economy in packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Carbon-Negative Packaging Market - The carbon-negative packaging market is predicted to expand from USD 96.75 billion in 2025 to USD 170.97 billion by 2034, growing at a CAGR of 6.53%.

- Closed-Loop Packaging Systems Market - The global closed-loop packaging systems market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Recycled Packaging for Apparel Market - The recycled packaging for the apparel market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Sustainable Films for Packaging Market - The global sustainable films for packaging market is projected to reach USD 392.7 billion by 2034, expanding from USD 191.04 billion in 2025.

- Packaging Solutions Market - The global packaging solutions market is set to grow from USD 1.307 trillion in 2025 to USD 1.907 trillion by 2034, with an expected CAGR of 4.33%.

- Europe End-of-Line Packaging Market - The Europe end-of-line packaging market is set to grow from USD 2.92 billion in 2025 to USD 4.46 billion by 2034, with an expected CAGR of 4.76%.

- BOPP Films Market - The global BOPP films market is set to grow from USD 31.51 billion in 2025 to USD 50.16 billion by 2034, with an expected CAGR of 5.34%.

- Europe Cigarette Packaging Market - The European cigarette packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Green Packaging Market - The green packaging market is expected to rise from USD 336.85 billion in 2024 to USD 564.58 billion by 2034, growing at a CAGR of 5.3%.

Regional Analysis:

Europe is dominant in the recyclable packaging market due to its strong regulatory framework, environmental awareness, and technological advancements. The European Union’s Circular Economy Action Plan and Packaging and Packaging Waste Regulation (PPWR) mandate high recyclability standards and drive innovation in sustainable materials. Governments enforce Extended Producer Responsibility (EPR), encouraging brands to adopt recyclable solutions.

Additionally, European consumers are highly eco-conscious, influencing demand for recyclable and responsibly sourced packaging. The region also benefits from well-developed recycling infrastructure and collaborative initiatives between the public and private sectors. These combined efforts position Europe as a global leader in recyclable packaging practices.

Germany Market Trends

Germany is a leader in the European recyclable packaging market, with over 67% of its municipal waste being recycled. The country has strong regulations like the Packaging Act (VerpackG) and utilizes the Green Dot system to encourage proper waste sorting and packaging recovery.

German consumers are highly environmentally conscious, and the country boasts an advanced waste management infrastructure. Additionally, Germany is home to major packaging companies such as ALPLA and KHS, which continue to innovate in recyclable packaging technologies.

France Market Trends

France has taken major steps to promote recyclable packaging through the implementation of its anti-waste law (AGEC), which bans single-use plastics and mandates the reuse and recyclability of packaging. The country is investing heavily in reusable packaging systems in both the foodservice and retail sectors. Notably, France is developing large-scale closed-loop recycling facilities, such as Veolia’s €95 million PET tray-to-tray recycling plant scheduled for completion in 2025. The market is also witnessing fast growth in bio-based and paper packaging solutions.

U.K. Market Trends

The United Kingdom, despite being outside the EU, closely aligns its sustainability policies with European standards. The country has introduced a Plastic Packaging Tax and is preparing to launch a national Deposit Return Scheme (DRS) and Extended Producer Responsibility (EPR) program. Due to the rapid growth of e-commerce, there is significant demand for recyclable packaging, especially paper mailers and mono-material plastic formats. The UK market emphasizes cost-effective, high-performance recyclable solutions and innovation in design simplicity.

Italy Market Trends

Italy is experiencing a steady rise in the adoption of bio-based and compostable packaging, especially in the food and agriculture sectors. The country is home to innovation leaders such as Novamont, known for its Mater-Bi compostable materials. While recycling infrastructure varies across regions, the Italian government is promoting the use of sustainable packaging through financial incentives and awareness campaigns. Italy also shows strong support for circular economy practices.

Spain Market Trends

Spain has reinforced its commitment to sustainable packaging through its 2023 Royal Decree on Packaging, which mandates that all packaging must be recyclable by 2030. The market is expanding rapidly in terms of paper-based solutions and recycled plastic packaging. Spanish retailers, like Mercadona, are playing a key role in advancing recyclable packaging by transitioning to more sustainable formats. The government is also actively supporting consumer education on proper recycling practices.

Netherlands Market Trends

The Netherlands is known for its pioneering circular economy policies and extensive closed-loop recycling systems. The country makes significant use of returnable and refillable packaging, particularly in the beverage sector. Dutch companies and government agencies are promoting innovation through smart packaging technologies, such as AI and digital labeling, to improve sorting accuracy and recycling traceability. The Netherlands continues to lead by example in sustainable packaging implementation.

Poland and Eastern Europe Market Trends

Countries like Poland and others in Eastern Europe are emerging markets in the recyclable packaging sector. These regions are seeing gradual improvements in recycling infrastructure, often supported by EU funding aimed at modernizing waste collection and sorting systems. There is increasing demand for affordable recyclable materials and eco-packaging innovation. However, regulatory implementation and consumer awareness are still developing and are expected to improve over the forecast period.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Segment Outlook

Material Insights

Plastic material holds the dominant position in the Europe recyclable packaging market due to its lightweight nature, durability, and cost-effectiveness. Advancements in recycling technologies have significantly improved the recyclability of various plastic types, such as PET and HDPE, making them more environmentally acceptable.

The strong demand from the food and beverage, personal care, and healthcare sectors also supports its dominance, as plastic offers excellent barrier properties and product protection. Additionally, the presence of robust recycling infrastructure in several European countries and a regulatory push for circular economy practices further encourages the use of recyclable plastics over other less adaptable packaging materials.

Paper is the fastest‑growing material in the Europe recyclable packaging market due to soaring consumer demand for eco-friendly alternatives, robust environmental regulations like the EU Packaging and Packaging Waste Directive, and innovative advancements in paper materials such as water‑ and grease‑resistant coatings, biodegradable laminates, and high‑strength corrugated boards.

Europe’s e-commerce boom further drives adoption, with brands opting for lightweight, customizable paper mailers, tapes, and inserts that support curb‑side recycling. Additionally, government incentives and green labeling standards, combined with powerful circular‑economy targets, push manufacturers towards paper packaging as a sustainable, high‑performance substitute for plastic.

Type of Packaging Insights

Bottles and jars dominate Europe’s recyclable packaging market because they effectively combine widespread recyclability, regulatory alignment, and strong consumer demand. Predominantly made from glass, PET, and HDPE, these containers are universally accepted in European recycling systems and retain material quality through multiple cycles. Their excellent barrier properties and leak-proof designs make them ideal for liquids, sauces, cosmetics, and pharmaceuticals, supporting product freshness and safety.

Additionally, their compatibility with high-efficiency automated filling and capping lines streamlines production. Strong regulatory backing through EU circular-economy directives, along with sustainability initiatives by brands, reinforces bottle and jar usage as a leading recyclable packaging type.

Bags and pouches are the fastest‑growing segment in Europe’s recyclable packaging market because of their remarkable blend of sustainability, cost‑efficiency, convenience, and innovation. Their lightweight, material‑saving design significantly reduces production, transport, and disposal costs, while resealable and single‑serve formats cater to busy, on‑the‑go consumers, especially in food, beverage, personal care, and pharma sectors.

Regulatory pressure, like the EU’s 2030 recyclability mandate and Extended Producer Responsibility schemes, drives brands toward mono‑material pouches that are curbside recyclable. Meanwhile, material innovation from compostable films to high‑barrier recyclable PE/PP enhances functionality without compromising environmental impact.

Application Insights

Food and beverages dominate Europe’s recyclable packaging market due to their critical role in preserving product freshness, maintaining hygiene, and aligning with stringent EU regulations. High demand for safety and barrier protection across dairy, beverages, ready meals, and snacks drives widespread use of recyclable PET bottles, glass jars, aluminum cans, paperboard cartons, and pouches.

Consumer preference for eco‑friendly packaging and rising environmental awareness further fuel adoption, while manufacturers use recyclable formats to meet circular‑economy mandates like the EU’s 2030 recyclability targets. Combined with advancements in material science and recycling infrastructure, food and drink applications firmly lead the recyclable packaging market in Europe.

The personal care and cosmetics segment is the fastest-growing application in the Europe recyclable packaging market due to rising consumer awareness about environmental sustainability and the harmful effects of plastic waste. Consumers are increasingly demanding eco-friendly packaging in beauty and skincare products, prompting brands to adopt recyclable materials such as glass, metal, and paper-based containers.

Regulatory pressures from the European Union, promoting circular economy practices and extended producer responsibility, further push companies toward sustainable packaging innovations. Additionally, premium and niche cosmetic brands are leveraging recyclable packaging as a marketing tool to appeal to environmentally conscious consumers.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in Europe Recyclable Packaging Market:

- In February 2025, Huhtamaki, a company that manufactures sustainable food packaging solutions, revealed the innovation of the recyclable single-coated paper cups ProDairy, especially for yogurt and dairy products.

- In June 2025, Mondi, a global leader in packaging and paper headquartered in Weybridge, U.K., signed a partnership with Saga Nutrition, a French pet food manufacturer, to develop recyclable packaging for Saga’s dry pet food product range.

Europe Recyclable Packaging Market Players

- The Brand Company, S.L.

- PERA LABEL and PACKAGING

- Mondi Group

- Stora Enso

- DS Smith

- Smurfit Kappa

- Stora Enso

- Mayr-Melnhof

- Amcor Plc

- ALPLA Group

- Costantia Flexibles

- Klockner Pentaplast

- Huhtamaki

- Suez

- Biffa

Segmentation in the Report

By Material

- Plastic

- Glass

- Paper

- Tinplate

- Wood

- Aluminum

- Others

By Type of Packaging

- Bottles and Jars

- Bags and Pouches

- Boxes and Cartons

- Trays and Containers

- Drums and Cans

- Others

By Application

- Food and Beverage

- Healthcare and Pharmaceutical

- Personal Care and Cosmetics

- Industrial and Chemical

- Consumer Goods

- Logistics

- Others

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5628

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Web Wire | Packaging Web Wire | Automotive Web Wire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.